Overview

Elite Capital & Co. Limited is a Financial Management company that provides project-related services including Management, Consultancy, and Funding, particularly for large infrastructure and mega commercial projects.

Elite Capital & Co. Limited is a Financial Management company that provides project-related services including Management, Consultancy, and Funding, particularly for large infrastructure and mega commercial projects.

Elite Capital & Co. Limited’s head office is located at 33 St James’ Square, London SW1Y 4JS, United Kingdom with our Board Members, Staff, and Agents being located across the Middle East, North Africa, Asia, Europe, and South America. It also has multi-lingual staff to ensure that we can accommodate all of our client’s needs.

Elite Capital & Co. Limited offers a wealth of experience in Banking and Financial transactions and has a range of specialized advisory services for private clients, medium and large corporations as well as governments. It is also the exclusive manager of the Government Future Financing 2030 Program®.

When required we can also customize and structure our products and services to meet the specific needs of our clients. We will continue to customize, structure, create and implement funding products and services as the need requires.

Elite Capital & Co. Limited has made strategic alliances with several organizations and companies which have given us access to international markets in Europe, Asia, Africa, Middle East, and GCC regions. This has given Elite Capital & Co. a substantial foundation of clients to build on, in addition to access to the markets that are most in need of the products and services we offer.

Aim

The aim of Elite Capital & Co. Limited is to facilitate the commencement and completion of Infrastructure projects, stimulate economy, create employment, and combat poverty.

Types of Project

Our services are suitable for all types of Infrastructure Projects in either Greenfield (Pre Operations Stage) or Brownfield (Operations Stage) including but not limited to Sea Ports, Airports, Railway, Bridges, Roads and Highways, Water and Sanitation Utilities, Energy, Communications, Hospitals, Schools and Social Infrastructure, etc. This includes other projects or activities that impact positively on the relevant country’s basic infrastructure including the manufacturing of components used in infrastructure (such as cement and steel) and infrastructure associated with mining and agribusiness.

Size of Project

Minimum of USD 50M (United States Dollars Fifty Million) and upwards.

Loan to Value

Up to 85% of project financing required.

Term

Up to 15 years for the design, build, and finance component and up to 30 years for the ongoing operation component.

Operation

Projects are executed on an EPC+F basis, which is Engineering, Procurement, and Construction plus Finance. We cannot execute BOO or BOT projects.

Locations

All countries can be considered. Countries currently engaged in war or politically unstable environments or sanctioned countries will not be suitable. All projects must adhere to local and international environmental, health, safety, and social standards as required.

Suitable for

Privately held projects, Public & Private Infrastructure Operators, National & Local Governments, NGOs, and Financial Institutions.

Funding Collateral

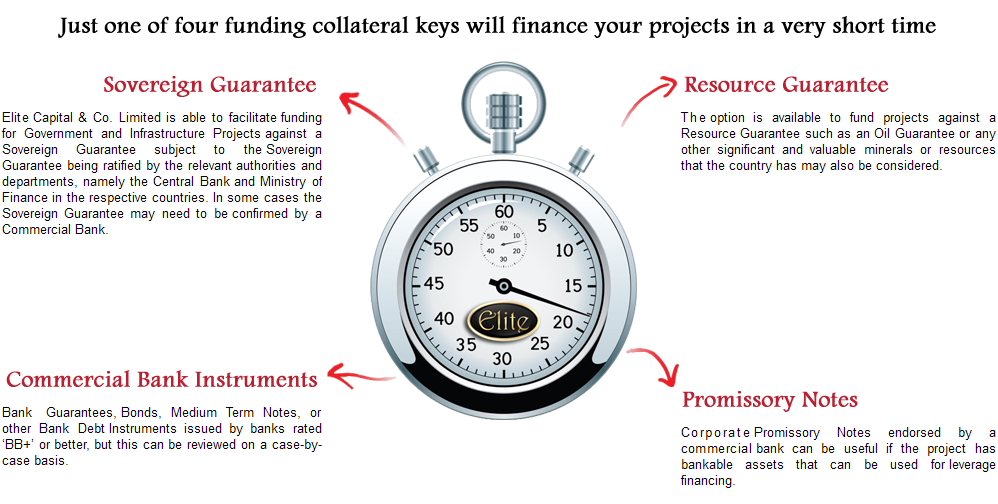

Commercial Bank Instruments; Bank Guarantees, Bonds, Medium Term Notes, or other Bank Debt Instruments issued by banks rated ‘BB+’ or better, but this can be reviewed on a case-by-case basis.

Sovereign Guarantee; Elite Capital & Co. Limited is able to facilitate funding for Government and Infrastructure Projects against a Sovereign Guarantee subject to the Sovereign Guarantee being ratified by the relevant authorities and departments, namely the Central Bank and Ministry of Finance in the respective countries. In some cases, the Sovereign Guarantee may need to be confirmed by a Commercial Bank.

Resource Guarantee; The option is available to fund projects against a Resource Guarantee such as an Oil Guarantee or any other significant and valuable minerals or resources that the country has may also be considered.

Promissory Notes; Corporate Promissory Notes endorsed by a commercial bank can be useful if the project has bankable assets that can be used for leverage financing.

Key Persons:

Dr. Faisal Khazaal, PhD. LLD. KGCC.

Chairman

Mr. George Matharu, MBA.

President and CEO

Mr. Simon Thomas

Vice President for Finance

Mr. Saleem Sarwar

Head of Trading

Mr. Kamran Nisar

Head of Real Estate

Mr. Lou Montilla

Senior Advisor (LNG, Crude & Products)

Eng. Dhergham Al Jarrah

Regional Director – Iraq

Mr. Ahmad Aboelyazeid, MBA.

Regional Director – Egypt

Barrister. Akram Al Zribi

Regional Director – Tunisia

Mr. Guillermo Hausman

Country Director – Mexico

Mr. Mustapha Zaitoun

Country Director – Morocco

Dr. Adnan Thewainy, LLD.

Senior Business Coordinator

Mr. Ebrahim Al Saqabi

Business Coordinator

Mr. Musallam Al Barami

Business Coordinator

Mr. Ben Liu

Business Coordinator

Dr. Bader Al Hosainan

Business Coordinator

Mr. Clive Grey

Business Coordinator

Mr. Alex Wan

Business Coordinator

Elite Capital & Co. Limited (“ECC”)

![]() ECC is incorporated with the Registrar of Companies for England and Wales at the Companies House, Cardiff, United Kingdom, on 6th September 2012. ECC incorporated under the Companies Act 2006 as a private company, the company is limited by shares, the situation of its registered office is in England and Wales, and the Standard Industrial Classification Code of this company is “70221 Financial Management”.

ECC is incorporated with the Registrar of Companies for England and Wales at the Companies House, Cardiff, United Kingdom, on 6th September 2012. ECC incorporated under the Companies Act 2006 as a private company, the company is limited by shares, the situation of its registered office is in England and Wales, and the Standard Industrial Classification Code of this company is “70221 Financial Management”.

Company Name

Elite Capital & Co. Limited

Registered Office

33 St. James’s Square, London, England, SW1Y 4JS

Company Number

8203510

Status

Active

Date of Incorporation

06 September 2012

Country of Origin

United Kingdom

Company Type

Private Limited Company

SIC Code

70221

Nature of Business

Financial Management

Paid Capital

GBP 32,817,000.00

The capital does not reflect the size of the company’s financial dealings.

Mortgage (Number of charges)

0 outstanding

0 satisfied

0 part satisfied

Previous Names

Legal Escrow Services Limited

Government Future Financing 2030 Program ®

On the 15th of October 2021, the UK Intellectual Property Office approved and issued a Registration Certificate for the Trademark ‘Government Future Financing 2030 Program’ with Certificate No. UK00003650455.

On the 15th of October 2021, the UK Intellectual Property Office approved and issued a Registration Certificate for the Trademark ‘Government Future Financing 2030 Program’ with Certificate No. UK00003650455.

Government Future Financing 2030 Program ® is an official United Kingdom ‘Finance Trademark’ by Elite Capital & Co. Limited under the following descriptions:

Trademark No.

UK00003650455

Status

Registered

Owner(s) name

Elite Capital & Co. Limited

33 St. James Square, London, England, SW1Y4JS, United Kingdom

Country of Incorporation

United Kingdom

Company registration number

8203510

List of Services

Corporate finance; Financing services; Project financing; Project finance; Finance services; Loan financing; Corporate financing; Financing of loans; Arranging of finance; Industrial financing services; Financing and loan services; Management of corporate finances; Financing of loans against security; Loans [financing]; Providing financing; Financially-guaranteed financing; Asset-based financing; Loans (Financing of -); Corporate finance services; Arranging finance for businesses; Financing and funding services; Financing of development projects; Financing services for companies; Facilitating and arranging financing; Financing of industrial activities; Arranging the provision of finance; Financing of short-term loans; Arranging finance for construction projects; Loans [financing] and discount of bills; Provision of finance for civil engineering constructions; Advisory services relating to investments and finance.

Legal Entity Identifier Code: 254900NNN237BBHG7S26

![]() Elite Capital & Co.’s 20-character alpha-numeric Legal Entity Identifier Code 254900NNN237BBHG7S26 was issued by Bloomberg Finance L.P. (Bloomberg), the accredited issuer appointed by the Global Legal Entity Identifier Foundation (GLEIF). The Legal Entity Identifier (LEI) initiative is designed to create a global reference data system that uniquely identifies every legal entity or structure, in any jurisdiction, that is party to a financial transaction.

Elite Capital & Co.’s 20-character alpha-numeric Legal Entity Identifier Code 254900NNN237BBHG7S26 was issued by Bloomberg Finance L.P. (Bloomberg), the accredited issuer appointed by the Global Legal Entity Identifier Foundation (GLEIF). The Legal Entity Identifier (LEI) initiative is designed to create a global reference data system that uniquely identifies every legal entity or structure, in any jurisdiction, that is party to a financial transaction.

Endorsed by the G20, the establishment of a Global LEI System (GLEIS) is critical to improving measurement and monitoring of systemic risk. Global, standardised LEIs will enable regulators and organisations to more effectively measure and manage counterparty exposure while also resolving long-standing issues on entity identification across the globe. To aid global allocation of LEIs, Local Operating Units (LOUs) have been formed and must be sponsored by local regulators to assign and maintain LEIs to firms on a cost recovery basis.

The use of the LEI has been mandated by the European Securities and Markets Authority (ESMA) for the reporting of derivative transactions to Trade Repositories under European Market Infrastructure Regulation (EMIR). Under MiFID II and Market Abuse Regulation (MAR), market operators are required to collate an LEI for each issuer with securities admitted to trading. All investment firms subject to MiFID II will be required to retain a valid LEI. Firms subject to the MiFID II transaction reporting obligations will not be able to execute a trade on behalf of a client who is eligible for an LEI and does not have one.

List of the G20 Countries (alphabetical order)

– Argentina

– Australia

– Brazil

– Canada

– China

– France

– Germany

– India

– Indonesia

– Italy

– Japan

– South Korea

– Mexico

– Russia

– Saudi Arabia

– South Africa

– Turkey

– United Kingdom

– United States

– European Union

Bloomberg Finance LP is an accredited issuer of the Legal Entity Identifier (LEI). As a Local Operating Unit (LOU) of the Global Legal Entity Identifier System, the company is responsible for the registration and administration of LEI records for over 200 countries.

The LEI is designed to uniquely identify legal entities that are participants in financial transactions, thereby helping to create greater transparency in the marketplace. The standard for this identifier and its associated reference data has been established in ISO 17442. It has been accepted for global use and has become a reporting requirement for several market regulators and authorities. Bloomberg also provides a free public database of all LEI data that it manages, giving users access to a valuable set of information when researching entity identification, risk, and exposure.

Bloomberg, the global business and financial information and news leader, gives influential decision makers a critical edge by connecting them to a dynamic network of information, people and ideas. The company’s strength – delivering data, news and analytics through innovative technology, quickly and accurately – is at the core of the Bloomberg Professional service, which provides real-time financial information to subscribers globally.

ISO 9001:2015 “QUALITY MANAGEMENT SYSTEM”

Elite Capital & Co. Limited (“ECC”) is certified as an ISO 9001:2015 “QUALITY MANAGEMENT SYSTEM” for the scope of Financial Management, Consultancy & Funding. Certificate Number INQ/EN-7802/1021. ISO 9001:2015 is awarded to companies that can demonstrate a number of quality management principles including a strong customer focus, the motivation of top management, a process approach, and continual improvement transactions.

Elite Capital & Co. Limited (“ECC”) is certified as an ISO 9001:2015 “QUALITY MANAGEMENT SYSTEM” for the scope of Financial Management, Consultancy & Funding. Certificate Number INQ/EN-7802/1021. ISO 9001:2015 is awarded to companies that can demonstrate a number of quality management principles including a strong customer focus, the motivation of top management, a process approach, and continual improvement transactions.

ISO 9001:2015 Quality Management System (QMS) is internationally recognized as the world’s leading quality management standard and has been implemented by over a million organizations in over 170 countries globally.

The purpose of the standard is to assist companies in meeting statutory and regulatory requirements relating to their product while achieving excellence in their customer service.

ISO 37001:2016 “ANTI-BRIBERY MANAGEMENT SYSTEM”

Elite Capital & Co. Limited (“ECC”) is certified as an ISO 37001:2016 “ANTI-BRIBERY MANAGEMENT SYSTEM” for the scope of Financial Management, Consultancy & Funding. Certificate Number INAB/EN-7803/1021. ISO 37001:2016 is the new international standard designed to help organizations implement an anti-bribery management system.

Elite Capital & Co. Limited (“ECC”) is certified as an ISO 37001:2016 “ANTI-BRIBERY MANAGEMENT SYSTEM” for the scope of Financial Management, Consultancy & Funding. Certificate Number INAB/EN-7803/1021. ISO 37001:2016 is the new international standard designed to help organizations implement an anti-bribery management system.

In the age of transparency, no organization can afford to take the risk of bribery lightly. Investors, business associates, personnel, and shareholders all need to be assured that the management has made every possible effort to prevent bribery at all levels of the organization.

The ISO 37001 standard is designed to help an organization implement and maintain a proactive anti-bribery system. The standard, which replaced the British Standard 10500, provides a number of requirements that represent globally recognized good practices for anti-bribery. The standard is applicable to all kinds of organizations.

ISO 27001:2013 “INFORMATION SECURITY MANAGEMENT SYSTEM”

Elite Capital & Co. Limited (“ECC”) is certified as ISO 27001:2013 “INFORMATION SECURITY MANAGEMENT SYSTEM” compliant for the scope of Financial Management, Consultancy & Funding. Certificate Number INIS/EN-8373/1221. ISO 27001 is the international standard which is recognized globally for managing risks to the security of information. ISO 27001:2013 (the current version of ISO 27001) provides a set of standardized requirements for an Information Security Management System (ISMS). The standard adopts a process-based approach for establishing, implementing, operating, monitoring, maintaining, and improving the company’s ISMS.

Elite Capital & Co. Limited (“ECC”) is certified as ISO 27001:2013 “INFORMATION SECURITY MANAGEMENT SYSTEM” compliant for the scope of Financial Management, Consultancy & Funding. Certificate Number INIS/EN-8373/1221. ISO 27001 is the international standard which is recognized globally for managing risks to the security of information. ISO 27001:2013 (the current version of ISO 27001) provides a set of standardized requirements for an Information Security Management System (ISMS). The standard adopts a process-based approach for establishing, implementing, operating, monitoring, maintaining, and improving the company’s ISMS.

ISO/IEC 27001, part of the growing ISO/IEC 27000 family of standards, is an Information Security Management System (ISMS) standard published in October 2013 by the International Organization for Standardization (ISO) and the International Electro technical Commission (IEC). Its full name is ISO/IEC 27001:2013 – Information technology — Security techniques — Information security management systems — Requirements but it is commonly known as “ISO 27001”.

Member of Deals Secure Group Holding Company – Kuwait

Elite Capital & Co. Limited (“ECC”) is a member of Deals Secure Group Holding Company. which is a holding company that is not involved in the activities of the ECC rather it is merely limited to collecting the annual profits from Elite Capital & Co. Limited for the benefit of the original owner after VAT & TAX are paid in-full to the United Kingdom Authorities.

Elite Capital & Co. Limited (“ECC”) is a member of Deals Secure Group Holding Company. which is a holding company that is not involved in the activities of the ECC rather it is merely limited to collecting the annual profits from Elite Capital & Co. Limited for the benefit of the original owner after VAT & TAX are paid in-full to the United Kingdom Authorities.

Funds Portfolio Manager

![]() The One Holy Catholic and Apostolic Orthodox Church has appointed Elite Capital & Co. Limited (“ECC”) to manage the portfolio of the Church (starting from Monday 6th of January 2014). The funds may be utilized for funding “Green Energy” projects and other similar ventures under the sole discretion of ECC. Note: This appointment was granted to Elite Capital & Co. Limited by the Church’s “Primate of the Americas” and “General Fiscal Agent” on 17th of December 2013.

The One Holy Catholic and Apostolic Orthodox Church has appointed Elite Capital & Co. Limited (“ECC”) to manage the portfolio of the Church (starting from Monday 6th of January 2014). The funds may be utilized for funding “Green Energy” projects and other similar ventures under the sole discretion of ECC. Note: This appointment was granted to Elite Capital & Co. Limited by the Church’s “Primate of the Americas” and “General Fiscal Agent” on 17th of December 2013.

D&B D-U-N-S® Number

![]() Dun & Bradstreet’s Data Universal Numbering System is a Number assigned to each business location in our global database. It is widely used as a tool for identifying, organising and consolidating information about businesses. Companies worldwide use it to link information about suppliers, customers and trading partners, providing them a more complete picture of risks and opportunities in their business relationships.

Dun & Bradstreet’s Data Universal Numbering System is a Number assigned to each business location in our global database. It is widely used as a tool for identifying, organising and consolidating information about businesses. Companies worldwide use it to link information about suppliers, customers and trading partners, providing them a more complete picture of risks and opportunities in their business relationships.

Registered Name

Elite Capital & Co. Limited

DUNS Number

21-857-2820

Money Laundering Prevention

![]() If you become a client of Elite Capital & Co. Limited (“ECC”) you will find that you are asked to confirm your identity and other personal details. ECC has established special verification systems involving your lawyer and bank to prove your identity. To safeguard the integrity of our deals, your contract(s) with ECC may also be subject to periodic transaction limits depending on your assets status.

If you become a client of Elite Capital & Co. Limited (“ECC”) you will find that you are asked to confirm your identity and other personal details. ECC has established special verification systems involving your lawyer and bank to prove your identity. To safeguard the integrity of our deals, your contract(s) with ECC may also be subject to periodic transaction limits depending on your assets status.

You could be asked to confirm your identity whether you are a new client or have been a client for some time. While our identity verification systems are designed to minimise any inconvenience for you, the verification process may take several days to complete.

Money Laundering Offenses

Crime and terrorism need cash. Criminals turn the “dirty” cash made from drug trafficking, smuggling, and robbery into clean money by using false identities or taking the names of innocent people. Making sure that people are who they say they are is essential in the fight against crime and terrorism. This does not mean in any way that suspicion is falling on the client. Any information about client identity is held confidentially and will help stop client identity being used falsely.

Anti-Money Laundering

HM Government and all organisations involved in financial services. All are united in their determination to stop the spread of financial crime as part of the international effort to crack down on financial crime – protecting us all against crime and terrorism. Therefore, client co-operation is vital to the successful fight against crime and terrorism.

Duties of Elite Capital & Co. Limited:

We may be required to verify client identity and address.

We are required to keep full records of all transactions together with identification provided.

We are required to monitor any unusual or suspicious transactions, contracts, and deals of any size.

We have a legal obligation to report to the National Crime Agency (NCA) any suspicious transaction.